by Whitney Downard, Indiana Capital Chronicle

July 26, 2024

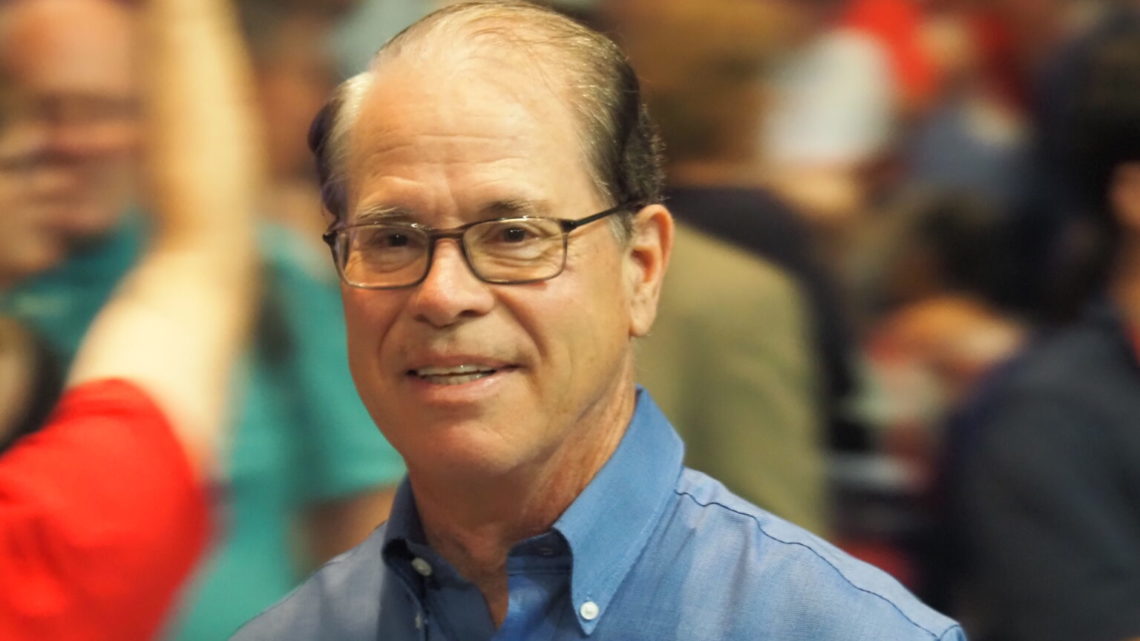

Republican gubernatorial nominee Mike Braun — Indiana’s junior U.S. Senator — on Friday released a proposal to reform the state’s property tax system, which is among Hoosiers’ top concerns following back-to-back, double-digit increases in assessed values.

However, the two-page plan — which came from the Indiana Republican Party and not directly from his campaign — didn’t include any fiscal analysis, nor did either group respond when asked for the impact on government coffers.

The four-pillar proposal includes immediate property tax cuts for homeowners as well as introducing a cap to limit future growth. Other portions of the proposal include transparency on tax calculations and reforming the tax referendum process.

“Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in home values. As Governor, I will introduce a bold agenda to deliver historic property tax relief for all Indiana residents,” Braun said in the party’s release.

According to an analysis by the Association of Indiana Counties and Policy Analytics, the gross assessed value of homes jumped 16.5% on average between 2022 and 2023 and property tax bills increased by 18.2% on average.

What I would ask seniors, if I’m trying to get them to think through what the right mix of taxes and services are, I would say, ‘Do you want to save $100 a year in property taxes … or would you rather have a community in your county that your grandchildren would like to move to?

– Mike Hicks, an economist with Ball State University

But the proposal would be a hit to local units of government — including school corporations — which rely on property taxes to fund local services like law enforcement, road maintenance and school operations.

Economist Mike Hicks, a professor at Ball State University, additionally observed that Indiana had a low tax burden when compared to other states. Business Insider reports that the median American homeowner paid $2,690 in property taxes while the median Hoosier paid $1,308 in median annual property taxes.

“Indiana already has very low taxes and so any effort to further reduce taxes necessarily starts to affect public services. At the same time … we have very low levels of service quality,” Hicks said. “… We’ve seen the effective tax rate, the amount of taxes that we’re paying in income has declined for more than two decades. I don’t think most Hoosiers know that.”

Hicks tied the ongoing attention to property taxes to Indiana’s “badly underperforming” economy, saying that efforts would better be spent addressing quality-of-life issues.

“The property tax proposals here are fixing a problem that’s in our past. We’ve already seen property values turn a corner; they’re now declining,” Hicks said.

“This proposal is very backward looking. A more forward-looking tax proposal would probably try to provide for … better local public services: education, public safety, parks and recreations. Things that attract residents and keep residents in Indiana.”

Plan details

Braun’s plan points to the state’s homeowner deduction, which is designed to reduce the taxable value of a home but “has not kept pace with rising home values,” according to the release.

Homeowners with an assessed value of over $125,000 would be allowed to deduct 60% of their home’s assessed value from their tax bill, while those below that threshold would take the standard deduction of $48,000 in addition to a 60% supplemental deduction.

The plan would return tax bills to 2021 levels, Braun told WIBC on Friday morning.

“This focuses on homeowners, to give them relief, and it gives disproportionate relief to homeowners of lower assessed value homes, the ones that probably have the most trouble paying it,” Braun said.

Additionally, future tax increases would be capped annually to 2% for senior, low-income Hoosiers and families with children under the age of 18. All other homeowners would be capped annually at 3%.

The Braun campaign says that the average Hoosier homeowner would have saved $1,000 over the last five years with this tax cap.

Any increases exceeding that cap must be approved through a referendum, a process under which “taxpayers are empowered to approve or disapprove of certain property tax increases,” the plan said.

But the proposal went on to say that “low voter turnout, misleading ballot language and unchecked referendum tax bill growth have led many Hoosiers to feel burdened by runaway referendums.”

Instead, “any” referendum to increase property taxes should occur during a general election, according to Braun, and “is subject to tax bill growth caps.” A referendum would be required to propose a total levy and data on the impact to the median home’s property tax bill.

Lawmakers unsuccessfully attempted to restrict school referenda to general elections last session, and have shown an interest in mandating clearer ballot language.

Braun additionally proposed making tax calculations more transparent by creating a “Property Tax Transparency Portal” where homeowners can compare their current tax bill with new versions.

More than just property taxes

Hicks said the proposal “purposefully ignore(d) the fiscal effect” on local units of government “because they’re stunningly bad,” adding that some localities could see revenues cut by 10% or even 30%.

“For schools, that’s a catastrophe, right? Because, already, schools are struggling,” Hicks said, particularly in transportation costs and in maintaining or repairing aging school infrastructure. “It’s always important to remember that if taxpayers are feeling inflation, so are local governments.”

“… If taxpayers are feeling it’s more expensive to have home maintenance and repair, imagine what it’s like for somebody who’s trying to maintain and repair a school that’s now 60 years old?” Hicks continued. “The real reason why most of these property tax proposals have not gained traction is because the effect on local government is rather steep.”

He also observed that the plan included no relief for renters, though roughly one-third of Hoosiers fall into that category. Because homeowners are wealthier than their renter counterparts, property tax cuts are regressive, meaning that they disproportionately benefit wealthier Hoosiers over low-income households.

“This is a gift to people who have been lucky enough to own a home and it’s a real wallop to people who are renters,” Hicks said. “This will, for most of them, be a tax increase because most of taxes flow to renters — they’re not paid by landlords.”

For Hicks, the bigger issue dragging down Indiana’s economy is the state’s low educational attainment levels. Because of the state’s underperformance on economic indicators — which can include wages, an area where Indiana also lags behind the national average — home prices have stayed low.

Economic upheaval tied to historically low interest rates caused a “blip” in home purchases, which raised assessed values and tax rates. Hoosiers, in turn, have pressured lawmakers to reform the state’s tax system, though Hicks said the impact was temporary.

Instead, the economy could be better boosted by focusing on efforts to cultivate, attract and retain a better educated workforce, Hicks said.

“The ‘Brain Drain’ is getting worse because we’re not aggressively making communities that people want to live in, particularly well-educated people,” Hicks said.

There are other ways to make property taxes more predictable for homeowners without sacrificing too much local revenue, he observed. Similar to how the state calculates taxes on agricultural properties, taxes could instead be based on a three-year average.

Election year politics

Hicks lumped the proposal with several others that have emerged during the gubernatorial election cycle, notably a plan from Lt. Gov. Suzanne Crouch to eliminate income taxes. Crouch lost to Braun in the May primary.

“Nobody likes property taxes and it’s an election year. The property tax proposals that I have seen, including this one and including income tax proposals, almost exclusively appear to be part of an electoral campaign rather than a serious analysis of the issues involved,” Hicks said.

Targeting tax breaks for seniors, he observed, is particularly prudent for politicians because older generations vote more reliably.

“What I would ask seniors, if I’m trying to get them to think through what the right mix of taxes and services are, I would say, ‘Do you want to save $100 a year in property taxes … or would you rather have a community in your county that your grandchildren would like to move to?” Hicks said.

“Because I can tell you … 70 or maybe 80 Indiana counties are places that the grandchildren of current 60 year olds are not going to move (to), particularly if they have a college degree.”

As the Republican nominee, Braun will face Democrat Jennifer McCormick and Libertarian Donald Rainwater in the fall. Rainwater has released his own property tax proposal, which would cap taxes based on purchase prices.

Democrats criticized Braun’s plan alongside a plan released earlier this year by Braun’s ultraconservative running mate, Micah Beckwith. Beckwith’s property tax plan would end the charges for certain seniors and veterans while also capping taxes at purchasing prices.

The Indiana Democratic Party said that both plans would “threaten the fiscal wellbeing of localities and communities across the state.” Capping taxes at purchasing prices, according to the party, would jeopardize long-term fiscal planning and budgets for public schools as well as community services.

“Hoosiers deserve real relief from rising property taxes, not gimmicks that would balloon local deficits, endanger local services, and suffocate Indiana’s housing market,” said Indiana Democratic Party Chair Mike Schmuhl in a statement. “From cutting care for our most vulnerable children to watching property taxes soar for seniors without immediate action, Indiana Republicans are proving they are not the party of fiscal responsibility.”

Instead, Schmuhl said McCormick — who hasn’t yet released a property tax proposal on her campaign website — would have a plan that would balance schools and keep seniors in their home while providing resiliency for local services.

Rainwater said Friday he planned to release a longer response to Braun’s plan on Monday but said the proposal had “many concerning elements.” Chiefly, he noted the plan didn’t protect Hoosiers from losing their homes to tax sales — his plan proposes abolishing asset forfeiture in relation to property taxes — and allowed annual tax increases “in perpetuity.”

“In summation, this is a band-aid meant to temporarily quiet the citizen’s concerns during an election year, instead of an actual resolution to the problem of Hoosiers never really owning their property,” Rainwater said in a release.

The road ahead

Property taxes, and especially referendums, have long been a topic of discussion for lawmakers seeking ways to reform the state’s tax system.

Though taxpayers approve referendums, homeowners might not always anticipate double-digit jumps in assessed values that drive up tax bills.

But local government leaders have pointed to growing service demands. Some schools report that their state payments aren’t enough and resort to referendums to close funding gaps.

Braun campaign senior advisor Josh Kelley likened the pitch to an “opening offer,” saying that it would have to be considered within the broader tax ecosystem. Currently, lawmakers are in a two-year process of reviewing that system.

“Senator Braun hopes that this will start a conversation around delivering effective government services without allowing budget creep. He looks forward to having these conversations with the General Assembly and with local government and school stakeholders. Senator Braun ranks among the most conservative and effective Senators due to his ability to pursue ambitious proposals and find pragmatic ways to deliver results,” Kelley said.

Any plan would need to pass through the General Assembly. Braun called the proposal a “template” for lawmakers and said he’d already consulted with legislators about it.

“This has all been vetted as being doable, if you’ve got the political will to do it,” Braun told WIBC. “… I’ve got to sell this. If you’re good at selling, you pre-sell it, right? And there’s an appetite for it. No one has just exercised the leadership to do it.”