by Whitney Downard, Indiana Capital Chronicle

September 24, 2025

The executive director of Indiana’s public retirement system cautioned lawmakers Wednesday that an effort to aggressively pay down unfunded liabilities won’t immediately free up more dollars — instead saying further analysis would be needed.

The Indiana Public Retirement System oversees nearly $55 billion in assets for 551,000 members across 16 accounts. The overall funding status of the system increased from 81% to 83.2% in the last year.

The state’s largest unfunded liability continues to be the Teachers’ Pre-1996 Defined Benefit Account, which has $3.1 billion in unfunded liabilities. The state budget dedicates $1 billion annually to pay down that account — which is on-track to reach funded status by 2028 or 2029, depending on market conditions.

“Everybody is anxious for that day that this money gets 100% funded,” said Steve Russo, INPRS’ executive director. “Anxious about, maybe, what they do with the money. But I want to be sure that it’s well understood the potential risk of this thing.”

He warned that the state would have to continually monitor, and potentially pay, to keep that funded status as market conditions shift. There’s also always a risk of a major economic downturn.

“We definitely look forward to engaging and collaborating, not only with just the leadership, but also the administration and the legislature,” Russo said.

Lawmakers, particularly Senate Republicans, have added large chunks of cash to accelerate payment of the debt in recent years when the state was flush with revenue. And leaders have eagerly waited for the day the state no longer pays $1 billion annually toward the fund. Those dollars could, instead, be used to invest in other programs or to further trim down Indiana’s marginal income tax rate.

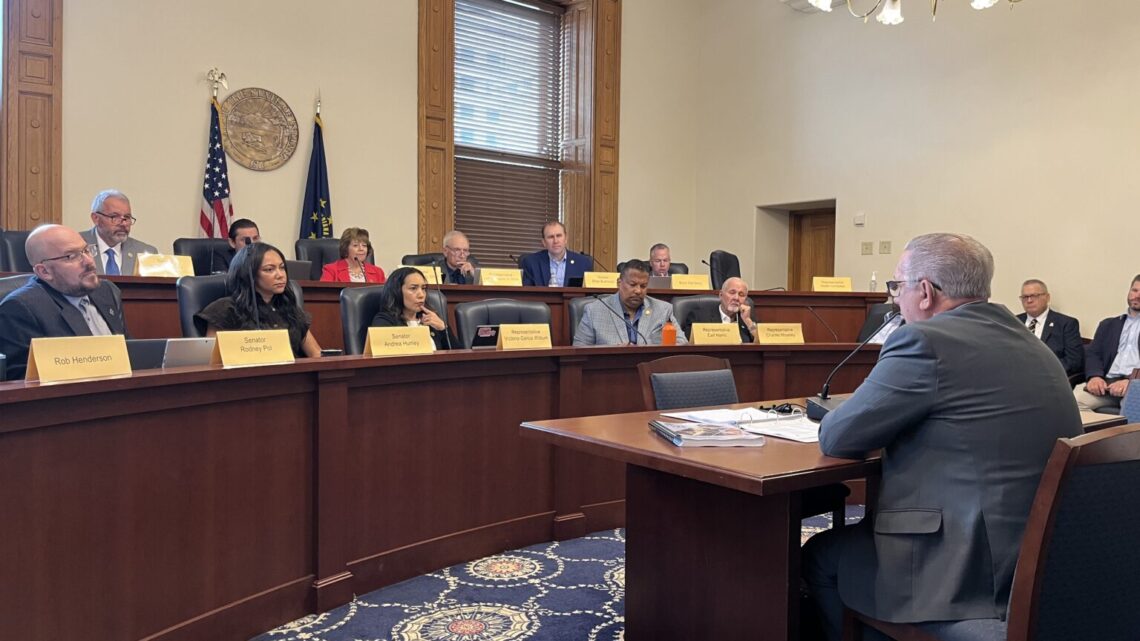

Russo also assured members of the Interim Study Committee on Pension Management Oversight that investments complied with requirements to divest from foreign adversaries, including China.

This comes after the Indianapolis Star pointed out the state had holdings in Hong Kong. Now the agency will divest.