by Leslie Bonilla Muñiz, Indiana Capital Chronicle

February 22, 2023

A substantially altered bill cracking down on Indiana’s public pensions and external investment managers cleared a key financial panel Tuesday — with a new projected fiscal impact of $5.5 million over the next decade. That’s much less than a previous $6.7 billion estimate, though Democrats still weren’t appeased.

House Bill 1008 seeks to block the Indiana Public Retirement System, the Indiana State Police Pension Trust and their respective publicly traded financial managers from making investment decisions based on environmental, social or corporate governmental policies, or ESG. The funds would have to divest from offending firms unless that would hurt pension members.

“These are policies that have been cooked up by Wall Street that are trying to push the sort of environmental policies, social policies and ideological things that could never pass through this legislature,” bill author Rep. Ethan Manning, R-Logansport, said Tuesday.

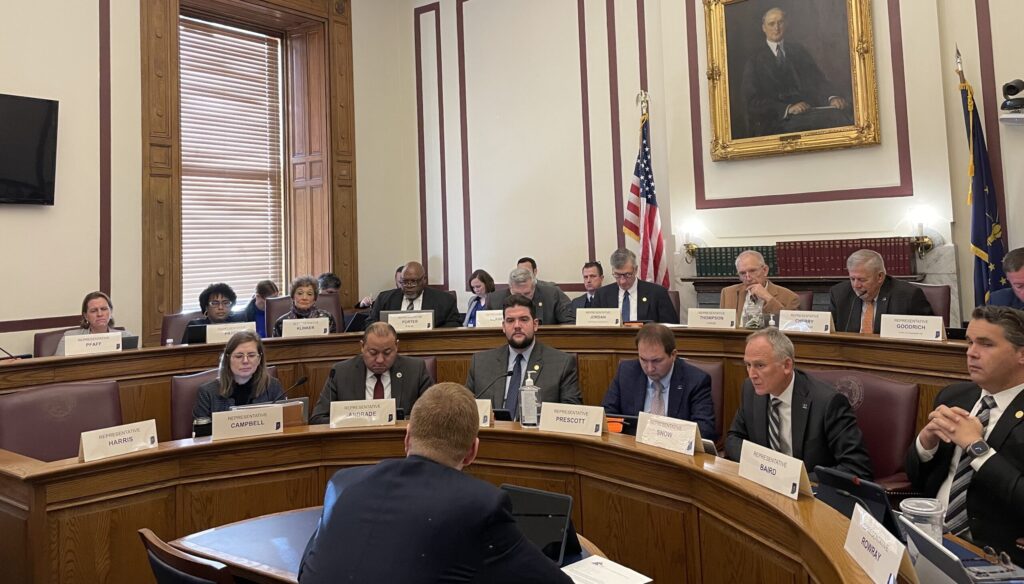

Manning said large financial management firms were “using their market power” to “push these policies on the private sector,” characterizing it as a “subversion of democracy.” He spoke before the House Ways and Means Committee, which must approve every bill with a financial impact.

“We have to push back against those ideas, and the available funds that we have to do that are large amounts of pension funds. INPRS has about $45 billion,” Manning added.

The bill defines what actions count as ESG investing — like investor leeriness of specific protected industries: firearms, fossil fuels and more. It also lays out enforcement mechanisms and proxy vote limits.

Bill subtly backs down

But to wipe out the previous — and staggering — financial impact, Manning introduced a substantial amendment that strategically declawed the bill.

The bill originally held external financial managers to the same standards as INPRS, applying in all activities — even to business dealings unrelated to the state of Indiana.

Manning’s amendment exempted private equity managers from key provisions, and specified that the bill applies only to what managers do “on behalf of assets managed for the public pension system.”

It also says that compliance doesn’t mean any additional obligations beyond what’s in a manager’s contract. Firms would still have to commit in writing to following the bill’s finances-first guidelines.

INPRS had previously feared the bill would “effectively eliminate private market investments and any active investment managers” — which it noted typically do better than public market indices. The changes largely alleviated those worries, according to an INPRS memo dated February 15 but that was circulated in committee Tuesday.

The amendment also specified that INPRS should track only the proxy votes made by fiduciaries — entities contracted to responsibly manage pension funds on the state’s behalf — rather than all proxy votes generally. INPRS typically has more than 200,000 of those votes, which are opportunities for shareholders to influence an entity’s management, annually.

The amendment also extended the entire framework, with some alterations, to the Indiana State Police Pension Trust. It wasn’t included before. INPRS doesn’t run that trust — its only trustee is the treasurer, who has already professed his enthusiasm for the bill.

Pushback persists, but bill passes

Manning said in committee that the changes would make the projected $6.7 billion impact “disappear.”

INPRS instead estimated in its memo that the new version of the bill would cost $550,000 annually: about $200,000 for custom proxy voting policy and infrastructure, and $350,000 for more staffing to manage the proxy voting setup. That adds up to $5.5 million over the original 10-year period.

Democrats still weren’t impressed.

In several lengthy exchanges, multiple Democrat lawmakers questioned and criticized Manning for the bill, suggesting it was unnecessary, administrative resource-intensive and could hurt pension members.

Rep. Ed DeLaney, D-Indianapolis, unsuccessfully introduced an amendment that would’ve made INPRS calculate the returns it would’ve recorded without the bill, and would’ve plugged the difference straight from the Indiana General Fund.

Rep. Ed Clere, R-New Albany, said he’d be concerned about the “open-ended effect” on that fund and wondered how INPRS would quantify what-ifs.

Another DeLaney amendment would’ve let people with defined-contribution plans pull their money out of INPRS.

“The reason I want to do this is because — why do I have the sense that this isn’t over, that this gun isn’t going to shoot one time in this attack?” DeLaney asked.

“Give people that opportunity, because I’m telling you: we are undercutting the public’s confidence in our plans and they ought to remove their money if they have that feeling,” he added.

Republicans pushed back repeatedly, arguing that the bill as amended would have a comparatively minor financial impact.

Manning also suggested that the Indiana Bankers Association, which opposed the bill in previous hearings, would be amenable to the new version — but the group told the Capital Chronicle that it is still opposed and that the banking industry would still be negatively affected.

The committee passed the bill 15-8, with all Democrats present voting against. Clere also voted no.

Correction: This story was updated to correct the latest bill version’s fiscal impact.

INPRS_Amended HB 1008 Fiscal Impact

Indiana Capital Chronicle is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Indiana Capital Chronicle maintains editorial independence. Contact Editor Niki Kelly for questions: info@indianacapitalchronicle.com. Follow Indiana Capital Chronicle on Facebook and Twitter.